Capital Introduction - how, what and where?

In the dynamic landscape of finance, hedge funds stand out as sophisticated investment vehicles that cater to high-net-worth individuals, institutional investors, and family offices seeking enhanced returns and risk management. As these investment vehicles continue to play a pivotal role in global financial markets, the process of connecting investors with hedge fund managers has evolved into a strategic practice known as Capital Introduction, or "Cap Intro."

Cap Intro serves as a crucial bridge, facilitating meaningful connections between investors and hedge fund managers. This article aims to demystify the concept of Cap Intro, shedding light on its significance, key components, and the intricate dance between investors and hedge fund professionals. Whether you are a seasoned investor looking to diversify your portfolio or a hedge fund manager seeking to attract capital, understanding the nuances of Cap Intro is paramount in navigating the complexities of the financial world.

Join us on this exploration of Cap Intro, where we'll delve into its origins, explore the strategies employed, and uncover the essential elements that make it an indispensable tool in the realm of hedge fund investments. Let's embark on a deeper understanding of Cap Intro, how it continues to shape the landscape of alternative investments and how AYU can help facilitate.

How do hedge funds meet investors?

Hedge funds employ a multifaceted approach to connect with potential investors in today's dynamic financial landscape. Firstly, hedge funds often partner with established financial institutions, such as investment banks, to leverage their extensive network and tap into their pool of high-net-worth individuals and institutional investors. Additionally, hedge fund managers actively engage in investor relations activities, participating in industry conferences, roadshows, and networking events to showcase their track records and investment strategies. Online platforms and professional networks also play a crucial role in facilitating connections between hedge funds and investors, allowing for virtual introductions, presentations, and discussions. Ultimately, hedge fund managers employ a combination of traditional and innovative methods to forge meaningful relationships with investors, demonstrating their expertise, performance, and the potential benefits of their investment opportunities.

What is a cap intro event?

Hedge fund cap intro events, also known as capital introduction events, serve as a crucial platform for hedge fund managers to connect with institutional investors. These events enable managers to showcase their investment strategies and performance records, while investors can evaluate potential opportunities for diversification and risk mitigation. Hedge fund cap intro events often involve presentations, one-on-one meetings, and networking sessions, allowing managers and investors to build relationships and discuss investment preferences and mandates. By bringing together fund managers and investors in a formal setting, these events facilitate the exploration of potential partnerships and help hedge funds gain access to capital from institutional investors.

Who invests in hedge funds?

Investing in hedge funds attracts a diverse range of individuals and entities looking to capitalize on alternative investment strategies. High-net-worth individuals, including successful entrepreneurs and business leaders, are often drawn to hedge funds for their potential to generate substantial returns and diversify their portfolios. Institutional investors, such as pension funds and endowments, also invest in hedge funds to increase their overall returns and manage risk. Family offices, which handle the wealth of wealthy families, may choose hedge funds to enhance their investment performance and preserve capital. In addition, some sophisticated retail investors and accredited investors participate in hedge funds to gain exposure to strategies and assets not typically available through traditional investment vehicles. Overall, the allure of potentially higher returns, diversification benefits, and access to unique investment approaches appeals to a wide range of investors seeking to augment their investment portfolios.

Is networking effective for hedge fund managers?

Networking is an essential and highly effective tool for hedge fund managers. In the fast-paced and competitive world of finance, building connections and fostering relationships can open doors to valuable opportunities. By engaging with industry professionals, hedge fund managers can gain insights into market trends, access deal flow, and learn from the experiences of their peers. Furthermore, networking allows managers to establish credibility and build trust with potential investors, thereby increasing their chances of securing funding - cap intro. Moreover, networking events and conferences provide platforms for managers to showcase their expertise and gain exposure for their funds. While networking requires time and effort, the benefits it brings to hedge fund managers in terms of valuable connections and access to resources make it a worthwhile investment in their careers.

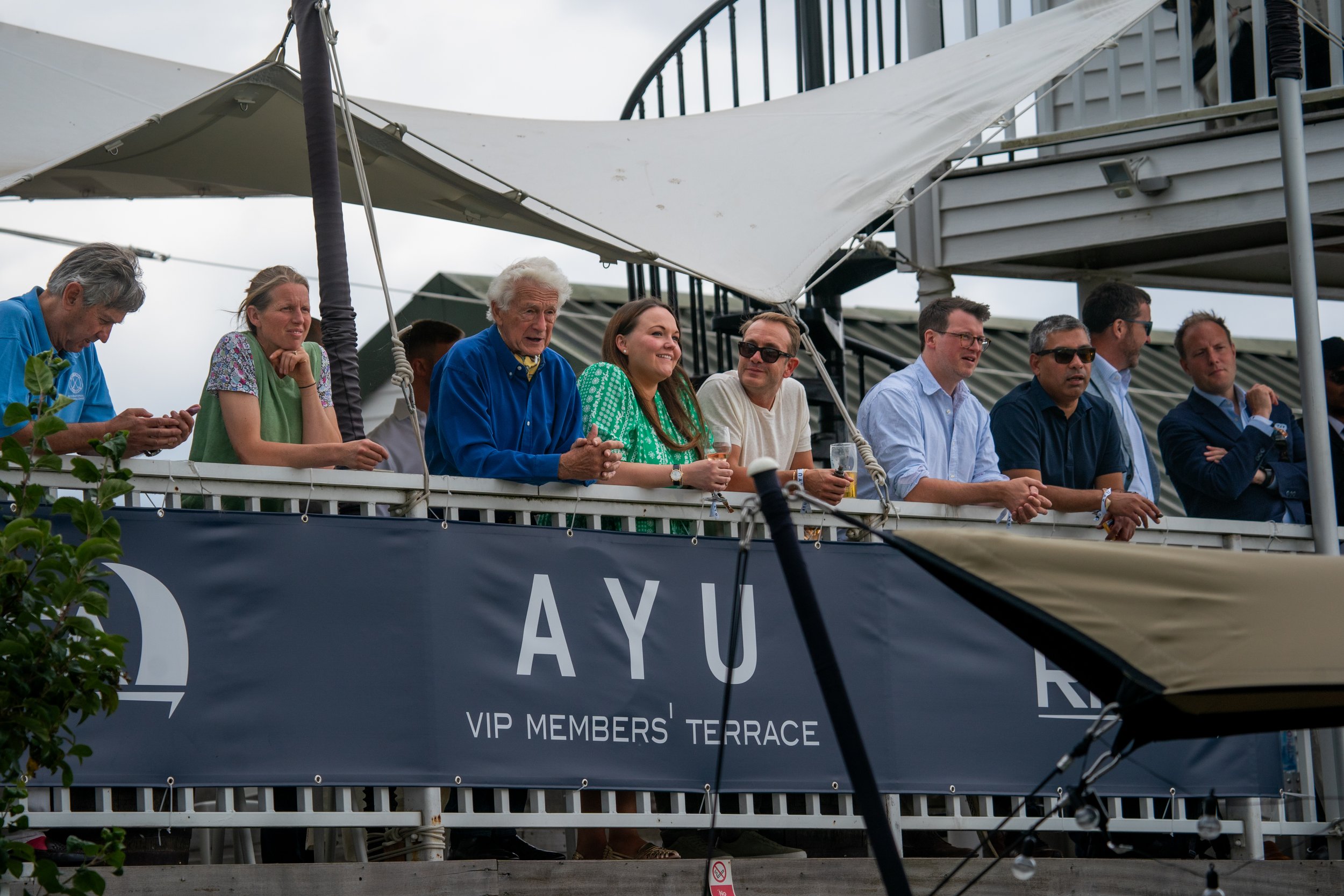

Cap intro events by AYU.

AYU magnifies and enriches these cap intro connections by bringing together allocators and funds for engaging social events that instill friendship and camaraderie leading to lasting, real connections, the place where real deals are made and investment synergies are sustained.

AYU takes a personalized approach to connecting investors with fund managers. Unlike other events that focus on mass introductions, AYU's cap intro events prioritize quality over quantity. The well-curated guest list ensures that investors have meaningful interactions with hand-picked fund managers who align with their investment preferences.

AYU's cap intro events provide a unique platform for networking and knowledge sharing. Through our Family Office Private Dinners, Fund Forums and Emerging Manager Conferences, participants gain valuable insights into market trends, investment strategies, and emerging opportunities.

Our dedication to fostering long-term relationships is what sets us apart. AYU connect, our dedicated, secure chat platform facilitates ongoing communication and collaboration between investors and fund managers post event, ensuring sustainable partnerships and future success. With our personalized approach, curated guest lists, knowledge-driven agendas, and commitment to relationship-building, AYU cap intro events offer a distinctive and rewarding experience for all participants.

The majority of AYU members are professionals working in hedge funds, family offices and institutional investment organisations and our community is carefully curated so all members are relevant to each other. All applicants must have peer references and are vetted by our committee. They must also adhere to our rules and etiquette to retain membership once admitted. We welcome members of all nationalities regardless of race, religion, age, orientation or identity A small minority of our membership is available to select industry service providers.

Join us for the next one?